By Georgiana Pop & Gonçalo Coelho (World Bank Group)1

Introduction

The goal of this article is to help in identifying competition constraints related to the development of an efficient and pro-competitive system of spectrum management system in West Africa, both at the national and regional levels. This is especially important for the ECOWAS region, where mobile telecommunications represents 8.7 percent of the gross domestic product (“GDP”) (a figure expected to reach 9.5 percent by 2023).2 The article builds on Pop & Coelho (2020) policy note “Getting the Competition Game Right in Mobile Communications and Radio Spectrum in West Africa: An Assessment of Regulatory Restrictions to Competition, World Bank Group, mimeo (‘Policy Note’). This Note was prepared in collaboration with the West African Economic and Monetary Union (“WAEMU”)3 (Competition and ICT Commissions), and the Competition Authority of Economic Community of West African States (“ECOWAS”).4 The Note was also informed by a comprehensive questionnaire on competition aspects related to radio spectrum management and competition enforcement in West Africa, which was completed and validated by the competition specialists and spectrum managers in the fifteen ECOWAS countries.

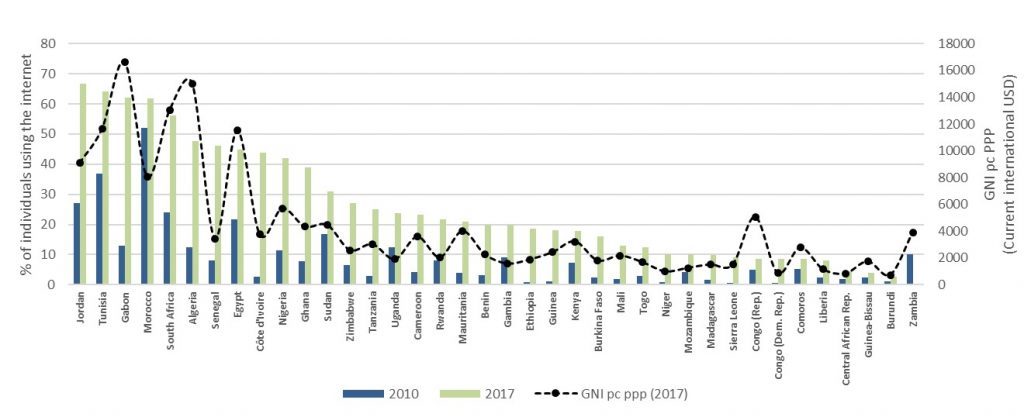

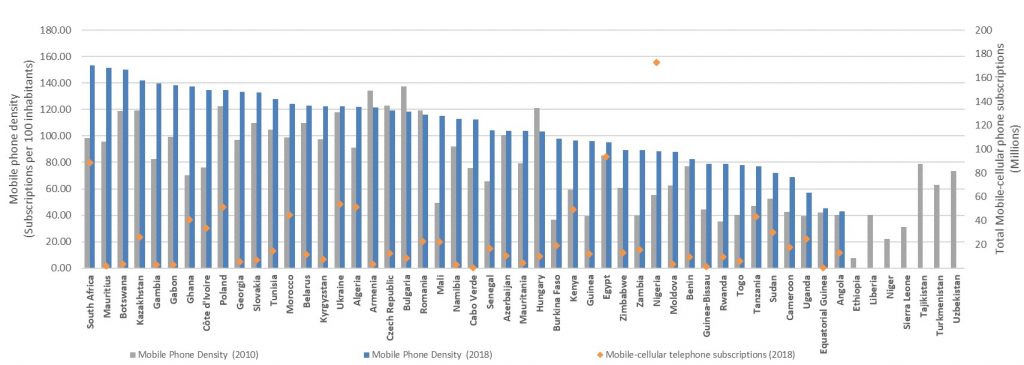

Despite having made great strides in the last decade, West Africa is yet to fulfil its mobile information and communications technology (“ICT”) potential, with ECOWAS countries still lagging behind other countries from the continent, in terms of mobile phone density and wireless broadband access (e.g. North African countries and South Africa – see Figures 1 and 2 below).5

Figure 1: Percentage of Individuals Using the Internet and Income Level Source: International Telecommunications Union – ITU (2017 & 2018)

Source: International Telecommunications Union – ITU (2017 & 2018)

Figure 2: Mobile Phone Density (2010 vs 2018) Source: International Telecommunications Union – ITU (2017 & 2018)

Source: International Telecommunications Union – ITU (2017 & 2018)

Radio Spectrum and Competition Restrictions

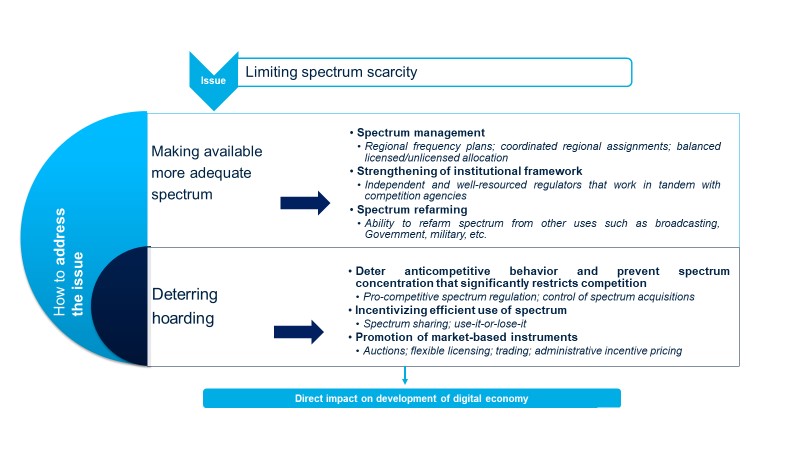

The article puts forward a conceptual framework to increase competition in mobile telecommunications in West Africa by, first and foremost, increasing the amount of adequate spectrum available for firms and consumers (see Figure 3 below). Underpinning the conceptual framework is the premise that mobile radio spectrum scarcity has contributed to limiting the development of mobile communications, and consequently of the digital economy in West Africa. To tackle this issue, a two-tiered solution is proposed, consisting of developing a substantive and institutional framework, both regionally and nationally, which can enable the release of adequate mobile spectrum, and preventing/deter spectrum from being efficiently used (i.e. spectrum hoarding).

Figure 3: Spectrum and Competition – A Conceptual Framework Source: Pop & Coelho (2020)

Source: Pop & Coelho (2020)

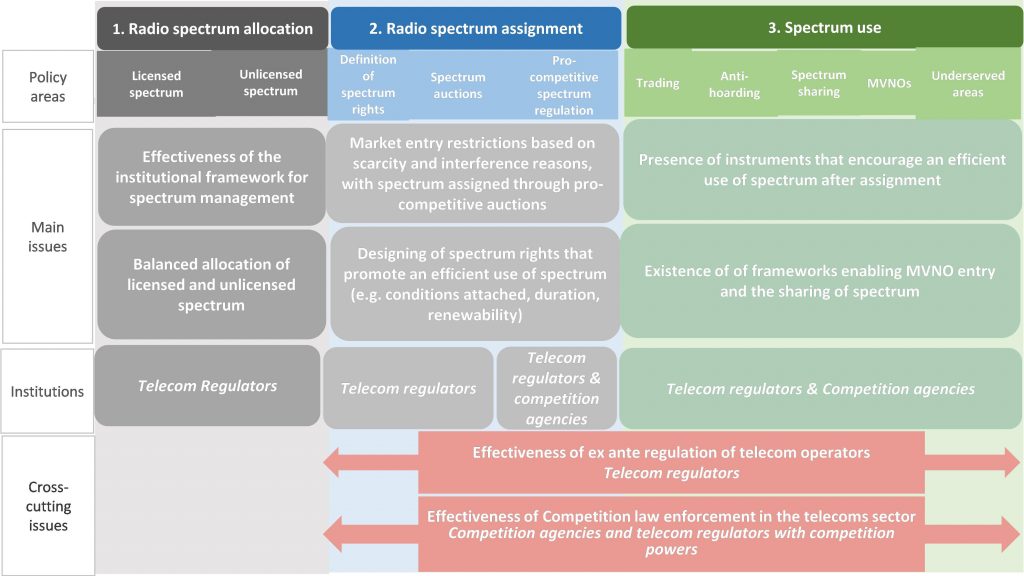

Based upon this conceptual framework, the Article develops a framework for assessing potential competition restrictions related to spectrum management and regulation. For this purpose, it breaks-down spectrum management and regulation into three categories, for the purposes of identifying the existence of competition-related bottlenecks: (i) spectrum allocation, (ii) assignment, and (iii) spectrum use. Furthermore, it also locates bottlenecks pertaining to the ex ante regulation of mobile operators and the ex post enforcement of Competition law (the so-called ‘cross-cutting bottlenecks’) – see Figure 4 below.

Figure 4: Framework for Assessing Competition Restrictions in Spectrum Management and Regulation

Source: Pop & Coelho (2020)

Note: In West Africa, spectrum licensing is in most cases a competence of the telecom regulator. There are however limited exceptions: in Guinea, spectrum licensing is a Ministerial power); in Mali, the revocation of spectrum authorizations is a Ministerial power, and in Senegal, the selection of spectrum licensees is carried-out by a Commission formed by representatives from the Government and the President.

Radio Spectrum Allocation

In West Africa, radio spectrum allocation (i.e. the process through which frequency bands are allocated for a specific use) has been characterized by national fragmentation and the lack of fully-functioning regional institutional setting. In ECOWAS, spectrum legislation provides for the creation of a National and a Regional Committee (consisting of two members of each national committee).6 However, the Regional Committee does not appear to be yet functioning, and 10 out of 15 West African countries do not have a national committee in place (Guiné Bissau, Guinea, Niger, Burkina Faso, Bénin, Senegal, Liberia, Togo, Cabo Verde). Absent an operating institutional regional framework, West African countries have privileged entering into bilateral agreements to solve multinational spectrum issues (e.g. The Gambia and Senegal; Mauritania, Cabo Verde and Senegal; and Niger with Burkina Faso, Bénin and Togo).

Thus far, West African countries have not always allocated the same bands for mobile use (voice and data). Despite forming part of the same ITU region, there is neither a mechanism for regional-wide spectrum allocation in West Africa, nor a follow-up mechanism for ensuring spectrum allocated at the EITU level is effectively made available. Moreover, West African countries have pursued different policies regarding unlicensed spectrum. For instance, five ECOWAS countries have not yet allocated spectrum for unlicensed use (Burkina Faso, Guinea, Guiné Bissau, Liberia and Senegal), and only a handful of jurisdictions have enacted guidelines on this topic (Ghana – currently under discussion – Mali, Nigeria, The Gambia, Togo).

Radio Spectrum Assignment

The definition of spectrum rights has not been regionally harmonized in West Africa, and its assignment (i.e. awards to specific mobile operators) remains a national competence.7 Although ECOWAS has adopted a comprehensive regulatory framework governing spectrum rights in 2007, an analysis of national regulatory frameworks shows that stark differences remain regarding spectrum rights duration, renewability and conditions attached.8 For instance, seven West African countries have licenses set case-by-case, which limit operators’ incentive to invest in their own infrastructure and/or increases the risk of administrative discretion (Burkina Faso, Ghana, Nigeria, Senegal, Sierra Leone, The Gambia and Togo).9 Furthermore, renewal of spectrum licenses is generally not automatic, bar Nigeria, where there is an implicit presumption of license renewability. Lack of predictability in terms of license renewal can limit incentives to invest in infrastructure and generally reduce pressure to compete in the market. In effect, there have been several cases where national regulators decided to suspend, cancel or not renew spectrum licenses without adequate prior notice (e.g. in Sierra Leone, Bénin, and Guinea). Finally, even though regional legislation establishes the principle of technology neutrality, only Ghana, Côte d’Ivoire and Guinea have actually adopted global licenses that cover more than one technology.

ECOWAS law, and nearly all West African countries establish the efficiency in spectrum use as a regulatory objective (with the exception of Mali). Accordingly, several West African countries demand regulatory authorities to assess the level of existing and potential demand for particular bands, in order to ascertain if there is actual or potential scarcity: The Gambia, Guiné Bissau, Guinea, Mali, Niger, Côte d’Ivoire, Togo, Bénin, Nigeria.

Also in line with the goal of instilling efficiency in spectrum use, ECOWAS law determines that spectrum should be priced in accordance with the opportunity cost for its use, and preferably through auctions. Notwithstanding the above, the telecommunications laws of most West African countries provide for a kaleidoscope of different methodologies unrelated to the goal of spectrum efficiency, and often introducing potential elements of discretion in setting the amount of fees and charges. These include: (i) calculation of the economic value of spectrum (Niger, Bénin, The Gambia, Cabo Verde); (ii) percentage of turnover of the mobile operator (Guinea, Mali); (iii) the pursuit of State objectives (Burkina Faso); or (iv) simply no clear legal criteria (Côte d’Ivoire, Liberia, Ghana, Sierra Leone, Senegal).

Hitherto, only Nigeria, Ghana, Senegal have implemented auctions, but results have been underwhelming. Even where auctions were adopted, high reserve prices combined with the lack of pro-competitive safeguards have limited positive competitive outcomes. For example, in Senegal, incumbents appear to have colluded to boycott a tender for 4G licenses in January 2016 by refusing to submit bids. In addition, staggered spectrum assignments has, in some instances, led to technological first-mover advantages (e.g. in Niger, Guinea and Burkina Faso, only one operator rolled-out a 4G network).

Similarly to the limited adoption of market mechanisms, West African countries have seldom put in place pro-competitive safeguards, such as set-asides10, spectrum caps11, bidding credits12, band plans13, or wholesale open access networks (WOANs)14. In West Africa, Nigeria is the only country to have adopted a single Wholesale Wireless Access Network operator (Bitflux) with open access obligations. Its prices are to be transparent and subject to price regulation by the Nigerian Communications Commission.

Radio Spectrum Use

In order to prevent operators from hoarding or inefficiently using spectrum, it is important to implement secondary markets that can enable an efficient use of spectrum throughout time. By trading and leasing spectrum, operators can voluntarily move spectrum to their most efficient use, provided such transactions do not pose problems in terms of harmful interference or competition.15 However, spectrum trading is currently only allowed by the telecommunications laws of Nigeria, Cabo Verde, The Gambia. Moreover, there appears to be no practice in this regard. 16 Other regulatory alternatives aimed at ensuring an efficient use of spectrum, with a more limited adoption in West Africa, include administrative incentive pricing (absent in ECOWAS/WAEMU) or the use of reverse auctions through which operators that are holding idle spectrum are incentivized to relinquish such spectrum (allowed in Nigeria, Burkina Faso, Bénin, but having been used in Nigeria only).

Use-it-or-lose-it obligations which allow regulators to impose sanctions or withdraw spectrum that is being inefficiently used can also play an important role in ensuring efficiency in use after spectrum is assigned. Use-it-or-lose-it obligations have been widely adopted in West Africa – 10 out of 15 ECOWAS/WAEMU countries, and have been enforced at least in Guiné Bissau, Côte d’Ivoire and The Gambia. On the other hand, there have been cases in West Africa where spectrum might have been inefficiently used for a considerable amount of time absent enforcement. For example, in Nigeria, Bitflux successfully bid for 30MHz of 2.3GHz spectrum in 2013. However, it took over 4 years to effectively start rolling-out its network and only in Lagos.

Mobile virtual network operators (“MVNOs”) have played a key role in developing innovative digital financial services in Africa, and by overall raising the competitive pressure on incumbents. For instance, First National Bank in South Africa launched an MVNO in 2015, which attracted more than 200,000 customers in its first year of operations. However, in West Africa, MVNOs are still largely absent, with the exception of Senegal, where 3 MVNOs operate, and Ghana, where the entry of an MVNO was approved in 2016 (not operational yet).

Nearly all ECOWAS countries (except for Guinea, Cabo Verde, The Gambia) have universal service funds (“USFs”) in place to ensure mobile coverage in non-commercially viable areas. Notwithstanding, our analysis shows there is still room for improving USFs performance through better management and by an institutional framework that ensures its independence from undue private and public interference.17 For instance, in a limited number of West African countries, the USFs lack independence from their line Minister, which could compromise the integrity of its decisions (Mali, Côte d’Ivoire, where the Fund is an SOE), or the USF has limited incentives to act efficiently (Côte d’Ivoire, Niger). USFs aside, other regulatory strategies to tackle the lack of infrastructure deployment in underserved areas still play a limited role in West Africa: (i) infrastructure sharing agreements have only been promoted by telecommunications regulators in Guinea, Togo, Niger, Bénin, Guiné Bissau and Nigeria; (ii) roaming agreements between competitors have been adopted in Côte d’Ivoire, Mali, Togo, Guiné Bissau and are being developed in The Gambia; and (iii) coverage obligations for rural areas have been set forth in Bénin, Guinea and Nigeria.

Mobile Telecommunications and Sector Regulation

Despite the existence of regional and national telecommunications regulatory frameworks, ex ante regulation of mobile operators with significant market power has not always been effective. Most ECOWAS countries assess significant market power (“SMP”) annually (Bénin, Burkina Faso, Côte d’Ivoire, Guinea, Guiné Bissau, Mali, and Niger), or quarterly, in the case of Nigeria. On the other hand, Cabo Verde, Ghana, Liberia, Senegal and The Gambia do not have clear periodicity rules, whilst Sierra Leone and Togo do not have a system of ex ante asymmetric regulation in place. In addition, most countries do not have periodic reviews of relevant markets, which can result in situations of over-regulation of operators that do not actually have SMP, as well as under-regulation of operators that may have acquired SMP in markets that have not been defined yet.18 Finally, Guinea, Senegal and Niger still use a formal test to determine SMP based on the market shares of the operators, which can also give rise to over-enforcement of ex ante regulation, in the absence of real market power concerns.

Ineffective regulation of MTR can reinforce the market power of operators that already benefit from the largest spectrum holdings in West Africa. MTR not calculated in accordance with the long-run incremental costs (“LRIC”) methodology tends to overestimate the termination charges as it incorporates non-relevant common costs. 19 20 A comparison of the various cost methodologies shows a heterogeneous landscape where LRIC is only adopted in Liberia, Cabo Verde, Bénin and Nigeria. Other methodologies in place include: (i) long-run average incremental costs (“LRAIC”) plus reference countries benchmarking (Côte d’Ivoire); (ii) vague cost-oriented criterion (Guinea, Mali and Senegal), (iii) bottom-up LRAIC (Ghana), and (iv) reference countries benchmark (The Gambia). Furthermore, although ECOWAS regional law determines that member states should introduce rules promoting number portability independently from the existence of SMP,21 there are still several countries which have not implemented such rules (Côte d’Ivoire, Nigeria, Ghana, Cabo Verde, Bénin).

In West Africa, Board members of telecommunications regulators do not always enjoy adequate independence safeguards, which may affect institutional stability and reduce incentives to act independently. This is especially the case of those countries in West Africa where: (i) Board members perform their functions without exclusivity (Sierra Leone, Ghana, Togo); (ii) telecommunications laws establishes overly broad reasons to dismiss Board members prior to the term of their mandate, as in Sierra Leone and Ghana (only Guinea determines that early dismissal on the grounds of gross fault criterion needs to be first established by court decision); (iii) telecommunications laws do not set forth objective selection criteria (this is the case of Niger where all Board members are Government representatives); and where (iv) Governments directly intervene in spectrum assignment (Guinea,22 Mali,23 Senegal).24

Competition Law and Mobile Telecommunications

Under WAEMU law, the Competition Directorate within the WAEMU Commission’s Department of Cooperation and Regional Market is bestowed with exclusive competence to enforce the competition rules.25 As a consequence, competition law enforcement is centralized at the regional level in WAEMU’s Commission; an authority that remains under-staffed and under-funded to fulfil its competition mandate. In reality, enforcement of the competition rules on anticompetitive agreements and abuse of dominance has been scant at the regional level.26 However, despite the prohibition of enforcing national laws, only Guiné Bissau still has not enacted a competition law in WAEMU.27

Pursuant to ECOWAS regional law, member states remain free to enforce their national competition rules in relation to anticompetitive practices which are likely to have an effect on trade within ECOWAS.28 An overview of national competition laws in ECOWAS shows that most member states have their own competition laws (with the exception of Ghana, Sierra Leone, Niger and Guiné Bissau – the latter two are also WAEMU countries), even though there is no enforcement agency in Liberia. Nevertheless, Ghana and Sierra Leone have not yet adopted national competition laws. As per anticompetitive practices with an effect on ECOWAS trade, enforcement belongs to the ECOWAS Regional Competition Authority, with the support of a Consultative Committee formed by two national representatives.29 However, the Regional Competition Authority is still in its early stages, having only started its activities on May 31st, 2018 (despite having been established in 2008).30

Despite the aforementioned regional institutional frailties, there have been several cases concerning the application of competition law to the telecommunications sector at the regional level. In particular, the Competition department of the WAEMU Commission has dealt with a variety of cases concerning the telecommunications sector and anticompetitive State regulation.31 At the national level, it is noteworthy how several countries entrust the enforcement of competition rules in the telecoms sector either to the telecoms regulator alone (Guinea, Liberia), or jointly to the competition agency and telecoms regulator (Côte d’Ivoire, Senegal, Burkina Faso, Cabo Verde).

Conclusion

In West Africa, mobile market outcomes have been hindered by the presence of various regulatory bottlenecks in all three stages of spectrum analysis, i.e. allocation, assignment and use. Despite the existence of solid regional frameworks governing radio spectrum, telecoms regulation and competition law, the institutions entrusted with putting such frameworks into effect typically are not fully effective yet.

Essentially, the key bottlenecks in mobile communications appear to be primarily of an institutional nature. Neither ECOWAS nor WAEMU appear to have in place the institutions necessary to further harmonize spectrum allocation of licensed and unlicensed bands in the EU. At the assignment stage, ECOWAS countries often depart from the existing spectrum regulatory framework in terms of the essential content of spectrum rights (namely, duration, renewability, tradability), and unilaterally decide which bands to make available for assignment, and the respective timing. Finally, as per spectrum use, there is a scant use of the regulatory instruments available to ensure efficiency in use, as well as coverage of non-commercially viable areas.

On top of these “three pillars,” cross-cutting bottlenecks consisting of an ineffective ex ante regulation of mobile telecommunications, and a weak competition law enforcement (ex ante and ex post) are further stifling effective mobile telecommunications markets in West Africa. First, ex ante regulation of mobile operators with significant market power has seldom been effective, which helped mobile incumbents strengthening their market dominance. Furthermore, sector regulators with spectrum mandates do not always have the adequate independence safeguards in place to shield them from undue private and public interference. Second, competition law enforcement in the region has been limited due to WAEMU’s prohibition of national enforcement of competition rules, and an uneven enforcement in the remaining ECOWAS countries. Additionally, regional enforcement of competition rules by WAEMU’s Competition Commission (2 decisions on anticompetitive conduct between 2013 and 2017), and ECOWAS’ Competition Authority starting its operations in 2018 only.

Click here for a PDF version of this article.

1 Georgiana Pop is the World Bank Group Global Lead for Competition Policy; Gonçalo Coelho is a Competition Policy Consultant, with the World Bank Group Global Competition Policy Team. Valuable inputs were provided by Clara Stinshoff and Ana Amador (Consultants, Global Competition Policy Team). The views and opinions expressed in this Paper are those of the authors and do not necessarily reflect the official policy or position of the World Bank Group.

2 GSMA (2019), The Mobile Economy in West Africa.

3 Benin, Burkina Faso, Côte D’Ivoire, Guinea-Bissau, Mali, Niger, Senegal, and Togo.

4 Bénin, Burkina Faso, Cabo Verde, Côte d’Ivoire, Ghana, Guinea, Guiné Bissau, Liberia, Mali, Niger, Nigeria, Senegal, Sierra Leone, The Gambia, and Togo.

5 GSMA (2019), The Mobile Economy in West Africa.

6 Supplementary Act A/SA.5/01/07 on the Management of the Radio Frequency Spectrum.

7 ITU Constitution: “while fully recognizing the sovereign right of each State to regulate its telecommunication…”

8 Supplementary Act A/SA.5/01/07 on the Management of the Radio Frequency Spectrum.

9 See case of the UK, licenses are presumed to last for an indefinite period, after their initial term: see ITU, Spectrum Management for a Converging World: Case Study on the United Kingdom.

10 Removes incumbent from the bidding process or reserves one or more blocks of spectrum for a specific type of bidder, such as a new entrant, a smaller operator or a designated entity or group (e.g. minorities, SMMEs, etc.).

11 Limit the maximum quantity of spectrum that can be held by an operator, in general, or in a specific geographic area

12 Subsidize a class of bidders to achieve the same objective of set-asides (e.g. by offering new entrants a discount on the winning bid).

13 Slicing of spectrum by geographic area and block size to facilitate market entry.

14 A WOAN consists of a network that provides wholesale services, in accordance with open access principles, such as transparency and non-discrimination, either on a voluntary basis or under a mandated access regime. In a wireless WOAN, the operator/licensee of the WOAN is awarded a large swath of high-value radio spectrum, which it then sells or leases to resellers active downstream. The WOAN model favors service-based competition by ensuring internet service providers (ISPs) and mobile virtual network operators (MVNOs) with access high quality spectrum, which they could not otherwise afford.

15 ITU World Telecommunications Regulatory Database: Some of the countries with a longer history of spectrum trading include the UK, New Zealand, Canada and Australia, as well as developing countries such as Guatemala and El Salvador.

16 ITU World Telecommunications Regulatory Database.

17 Ladcomm Corporation, “Survey of Universal Service Funds: Key Findings,” GSMA, 2013: USFs often face institutional challenges, with a 2013 GSMA study pointing-out that, out of 21 USFs surveyed in Africa – The survey covered the following African countries: Burkina Faso, Côte d’Ivoire, DRC, Gabon, Ghana, Lesotho, Madagascar, Mauritius, Morocco, Mozambique, Niger, Nigeria, Rwanda, South Africa, Swaziland, Togo, Uganda, Zimbabwe.

18 Only Bénin establishes that markets should be reviewed every three years.

19 European Commission Recommendation of May 7, 2009 on the Regulatory Treatment of Fixed and Mobile Termination Rates in the EU (2009/396/EC): “Taking account of the particular characteristics of call termination markets, the costs of termination services should be calculated on the basis of forward-looking long-run incremental costs (LRIC). In a LRIC model, all costs become variable, and since it is assumed that all assets are replaced in the long run, setting charges based on LRIC allows efficient recovery of costs.” (Recital 13).

20 When a dominant player’s on-net calls are cheaper than off-net calls, subscribers have the incentive to call the subscribers of the same operator as well as to join the dominant operator’s network so as to benefit from the possibility of calling much broader subscribers at a cheaper price (a “club effect”). Hence, the on-net/off-net differentiation can have a foreclosure effect on smaller operators.

21 Supplementary Act A/SA.4/01/07, Article 5(b).

22 Spectrum licensing is a Ministerial power.

23 Revocation of spectrum authorizations is a Ministerial power.

24 Selection of spectrum licensees is carried-out by a Commission formed by representatives from the Government and the President.

25 Article 90 of the WAEMU Treaty.

26 Julia Molestina, Regional Competition Law Enforcement in Developing Countries (Springer, 2019), pp. 175-176; Union Européene et UEMOA, Étude pour la Définition d’un Cadre de Référence de la Politiquue Communautaire de la Concurrence de l’UEMOA” (2017): in the period between 2003 and 2017, the WAEMU Commission adopted only 10 decisions on substantive matters: (i) anticompetitive agreements (1 decision); abuse of dominance (1 decision); mergers (2 decisions); State aid (4 decisions); and anticompetitive State action (2 decisions).

27 Niger has adopted a competition law following the World Bank Group’s recommendations, and is in the process of setting-up a competition agency.

28 Article 4(1) of Supplementary Act A/SA.1/06/08.

29 Supplementary Act A/SA.1/06/08, Article 13(4) and (5): and an additional representative from a sector-specific regulator or of a professional association whenever the issue dealt by the authority is economically important to that sector.

30 Article 13(1) of Supplementary Act A/SA.1/06/08’ and Articles 2 and 7 of Supplementary Act A/SA.1/06/08; headquarters in The Gambia.

30 E.g. (i) a complaint by CELTEL against the State of Niger for placing difficulties in the civil works for the roll-out of fiber optic; (ii) Sotelma and Malitel’s refusal to be part of a free roaming agreement between Senegal and Mali (case that is still going on); (iii) a complaint against Niger for anticompetitive regulation on international gateway; (iv) the assessment of the Orange/Airtel Burkina merger; and (v) the assessment of the mobile money joint venture between Orange and MTN across the region.